What FQ is not

Thank you to everyone who joined our newly launched #FQMondayHabit. It’s our seventh anniversary project for our Youtube channel Every Monday at five in the afternoon, we post a new video that aims to guide you through your FQ Journey. If you haven’t started the Monday habit yet, here’s the https://youtu.be/PBhrH0u6Gr0

Knowing what it ain’t

Have you ever had this conversation?

Friend 1: Let’s eat out?

Friend 2: Let’s do that. Where do you want to eat?

Friend 1: Any.

Friend 2: Okay, let’s go to Restaurant A (a Filipino restaurant).

Friend 1: I don’t like, their food is greasy there.

Friend 2: Okay, how about Restaurant B (an Italian restaurant).

Friend 1: Maybe not, their food is too heavy.

Friend 2: So, let’s go to Restaurant C (a Chinese restaurant).

Friend 1: No, not that restaurant, they use a lot of MSG there!

There are so many versions of this kind of conversation. When my husband and I try to choose what we want to watch on tv, an answer of “anything” could lead to something similar to the above conversation, “Ay ayoko yan!” “Ayoko rin yan!” “That’s too violent for my taste right now.” and so on.

When you’re trying to set up a friend on a date (we used to call it blind date, uso pa ba yon?), knowing what the person doesn’t like actually helps more than knowing what he/she wants.

It’s because most of the time, we don’t know what we really want, but our feelings are pretty strong about what we don’t want. So, articulating what we don’t want leads us to know and understand what we really want. It is true for the choice of restaurant, tv show, movie, a blind date, and so many other things. We are better off knowing what “ain’t” in order to narrow down the choices and have a better understanding of what is.

The same is true for what FQ (Financial Quotient) is. It is important for us to really understand this intelligence because it is an essential 21st century skill. Or should I say, an essential skill for all seasons and eras.

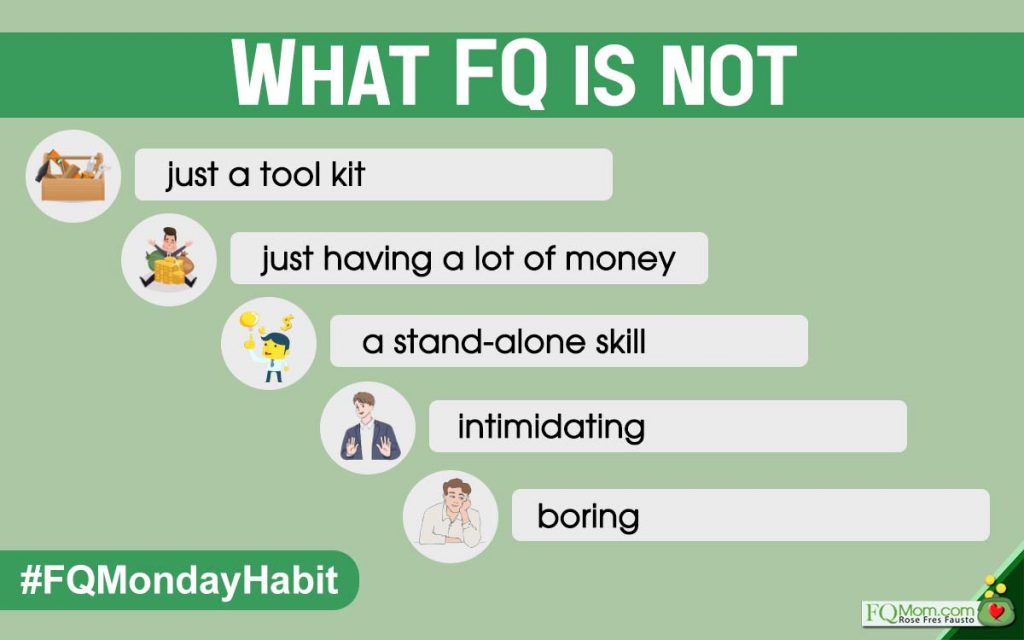

So, in order to fully understand what FQ is, let’s discuss what FQ is not.

1. FQ is not a mere tool kit or set of skills that can be easily passed on through textbooks, exercises, and tests. Yes, there is a need to understand how interest is computed, what inflation rate is, etc., but it is so much more than that.

2. FQ is not just about having a lot of money.

You may have all the money in the world, but if you’re too afraid to lose it or too uncomfortable having it, you will not be financially happy; thus, still low FQ.

3. FQ is not a stand-alone skill but is essentially a value system.

It should intersect with the things that you hold important in your life. A high FQ is a realization of the fact that money is a tool to achieve happiness and meaning in life; hence, any talk of FQ is necessarily related to an awareness of our core values. The absence of this awareness may lead to abundance in material wealth with a feeling of emptiness because if what you do with and for money does not align with your core values, no amount of money in this world will make you happy.

4. A high FQ does not necessitate one’s knowledge of highfalutin’ finance jargon.

In fact, I revolt the use of lots of these hard to understand finance gobbledygook. Even the world’s greatest investor Warren Buffet frowns at this use of difficult to understand investment jargon. You can have a high FQ without using all those intimidating terms. In fact, being able to explain finance concepts to a seven-year-old should be the mark of truly understanding them. (In FQMom.com we have an article series called Explain to me as if I were a seven-year old explaining finance concepts that can be understood easily.

- Why do higher interest rates bring down bond prices?

- Why should our young kids be invested in the stock market?

- Why do stocks give the highest returns among all asset classes in the long run? (Explain to me as if I were a 7-year old Series #3)

- The Magic of Compounding (Explain to me as if I were a 7-year old Series #4)

- What is Hyperbolic Discounting? (Explain to me as if I were a 7 year old Series #5)

Moreover, shying away from hard to understand morphed financial inventions can serve as your filter and protection to what may potentially be scams.

Sometimes I wonder if there is an unspoken conspiracy among some finance people to use these hard to understand terms in order to justify huge fees. The problem is that this could really get us in trouble. And I’m talking massive meltdown affecting the whole world! Remember the 2007-2008 Financial Crisis? Ever heard of CDOs (Collateralized Debt Obligations), Synthetic CDOs (Synthetic Collateralized Debt Obligations), Credit Default Swaps, Sub-Prime Mortgages, Mortgage-Backed Securities, Option ARM (Option Adjustable Rate Mortgage), Mortgage Resets, Good Faith Estimates, Negative Amortization, Teaser Rates? It seems that nobody dared to cry, “The emperor has no clothes!” — meaning “What the hell are you selling us? Why are these papers rated Triple A?” “Explain to me in simple language how my salary can pay all these amortizations?”

And the explanation why those transactions proliferated can only be either of the two:

a.) Due to ignorance; or

b.) Awareness with approval, because the money coming in was too good to stop.

Of course, there were a few who understood what was going on and made huge amounts of money betting on the opposite side. (You may want to read the book The Big Short by Michael Lewis or its movie adaptation if you care to understand what happened during the meltdown.)

5. FQ is not (and should not be) boring.

Several years after I left my investment-banking career and started attending investment forums again, I was surprised to find myself getting bored. Gosh! Was that the industry I left? Was that how boring my own presentations were? There’s a common vicious habit among presenters to dump dozens of bullet points on a single slide! Then they use it as their guide and say practically the same things written on the slides with a bit of ad lib. Duh! Is this a read out loud presentation? Then they follow it up with loads of numbers, tiny numbers and start talking about them. What are they thinking? Can anyone really read them? Not me and probably none of the other middle-aged people in the audience. Even the younger ones with better vision probably couldn’t care less. They’d rather check their social media updates than figure out those tiny numbers.

I remember a comment from someone who left the finance industry. She is now running a major movie production house that was started by her mother decades ago. She requested to meet my sons when she saw their dance on YouTube (Fausto Brothers 2011 Dance), and this was what she said when she gave us her work background, “I’m actually an accountant and I worked in the US, but you know naman how boring finance could get!” I was taken aback and said, “Huh! Boring? My husband and I are both finance people, by the way.” But later on I realized, “Yeah! She could be right.” And of course, what could be more exciting than showbiz? But then again, understanding how to make (and keep) loads of money should be exciting too!

Boring and Intimidating.

Unfortunately, numbers 4 and 5 are usually seen in a lot of finance literature. In FQ Book 1, I illustrated the difference between a lengthy prospectus piece on interest rates consisting of 159 words versus the way Warren Buffett wrote it in 71 easy to understand words.

Sometimes I wonder, “Are the boring and intimidating reputation of Finance the reason why not a lot of people get into the field?” Don’t you notice how kids these days would rather go into marketing, advertising, etc.? Most of the time, only the nerds and the geeks opt to enter Finance. And these two characteristics (i.e. boring and intimidating) could also be the reasons why a lot of people don’t bother honing their FQ. It’s too boring and intimidating!

The reality is FQ is about human behavior and money, subjects that are very interesting when presented the right way. I hope by now, you already know what FQ is not so you can better understand what FQ is. Fully understanding FQ and applying its principles are not a one-shot deal, it’s a journey so I invite you to have your FQ Journey with me and your loved ones. Invite them to join you in this #FQMondayHabit.

And to add a little fun (promise, not boring and intimidating), join our show on Kumu and FB Live on Thursday. We will talk about earning from your creative talents, with a special guest, Kara Pangilinan, an architect who is also the founder and owner of Details Ink, and also a yoga teacher.

ANNOUNCEMENTS

1. Thank you to everyone who greeted me on my birthday last Saturday.

2. I’ll be guesting in Math Dali with host RobiD on September 8.

3.. On September 10, 2021 I will give a talk about Loan 101: The Basic of Borrowing.

4. . Join us on September 11, 2021 as we discuss about Side Hustle (Earn Extra).

5. Start your week with the objective of learning ways to improve your FQ life, #FQMondayHabit on FQMom Channel & FQMom Page.

6. I invite you to subscribe to my new FQ Mom Podcast. If you’d rather consume this article in audio and listen to my additional comments and insights, you may listen to my podcast on the platform of your choice.

7. To learn more about your money behavior, get your copy of FQ Book 2. Get copies for your loved ones too. The principles you will learn from here are not only applicable in your financial life but all the other important aspects of your life. https://fqmom.com/bookstore/

To know more about FQ Book 2, watch this short video .

8. How good are you with money? Do you want to know your FQ Score? Take the FQ Test and get hold of your finances now. Click the link https://fqmom.com/dev-fqtest/app/#/questionnaire

This article is also published in Philstar.

Attribution: Dribble, Vector stock, Vecteezy, Freepik