Still the Sick Man of Asia? A Probe into the Philippine Economic Puzzle

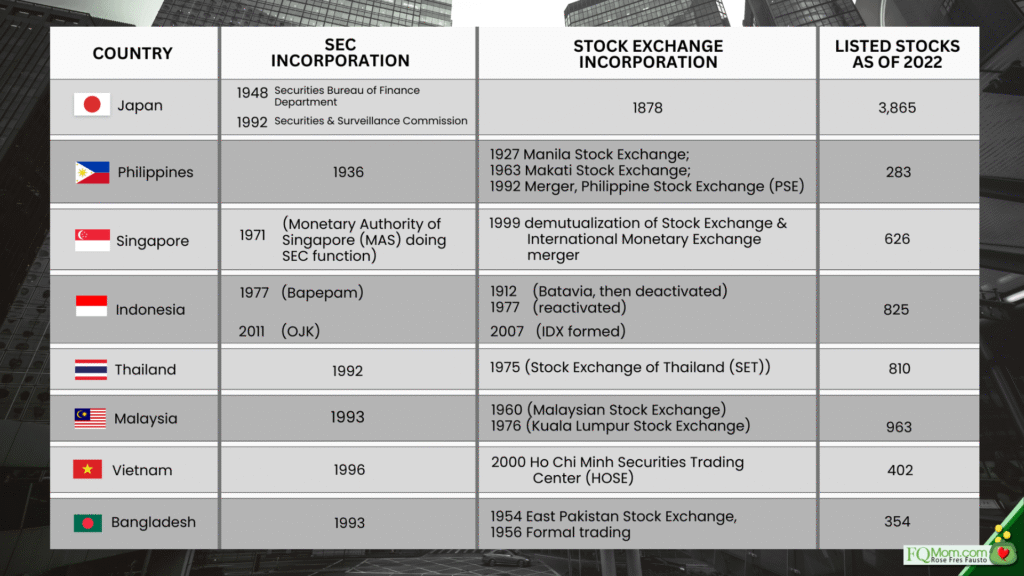

Years ago, the Philippines was considered second only to Japan in economic standing in Asia. We were ahead of our ASEAN neighbors in literacy, infrastructure, and promise. As a young investment banker in the ‘90s attending regional forums, I was talking to a delegate from Thailand and was surprised to find out that his country had just incorporated its Securities and Exchange Commission in 1992 while ours had been there since the kopong-kopong year of 1936! In fact, the same is true for the other neighboring countries as shown in the table below.

Fast forward: Decades later, the narrative has reversed. Countries like Vietnam, Indonesia, and even once-war-torn Cambodia are racing ahead, attracting investments, creating jobs, and lifting millions out of poverty—while we remain stuck, often celebrated for potential, rarely for performance.

Why do we remain stuck?

This question has weighed on me deeply, especially after two recent events I was part of.

On August 7, 2025, I co-hosted an event, representing SAGE (Samahan ng mga Atenistang Graduate ng Economics) as its president, together with TNB Aura (a Singapore-based venture capital). At this event titled From Boardrooms to Backers—a gathering that aims to bridge experience, talent, and investment—I delivered the opening remarks that celebrated private sector dynamism and the importance of unlocking long-term value. The energy in the room was hopeful. Yet one can’t help but wonder: With this much talent and capital around, why do we still lag behind?

The following day, I was at the forum of Shareholders’ Association of the Philippines (SharePHIL), where the new SEC Chair Atty. Francis Lim was the guest speaker. A man whose resumé tells you that he’s been at the helm of the Philippine regulatory and business ecosystem—former head of the Philippine Stock Exchange (PSE), past president of SharePHIL, Management Association of the Philippines (MAP), Financial Executives Institute of the Philippines (FINEX), among others.

I took the opportunity to ask him this question:

“You’ve been the head honcho of many regulatory and business institutions, so more or less you’ve seen what is really wrong, why can’t we achieve that development that all of us here have been hoping for, for decades now? Knowing what you know now, if you were the holistic doctor of the sick man of Asia, how would you cure him? What should really be done, sir?”

His response:

“I have a theory. Our capital market is like this because we have done little things that we’re not supposed to do, and we have not done little things we were supposed to do. These little things accumulated over the years and that is why we/re here. Why will investors entrust their money in us if we can’t even do the little things we are supposed to do.”

He went on to give an example: Exemptive reliefs (exemption from compliance with the law) from extending the directors over the nine-year period will be far in between. When I pressed for an answer on the “holistic doctor approach” even asking him to imagine if he suddenly became the president, he refused to answer. He later said market integrity and discipline are what we need.

In every economic forum that I attend, the underlying tone is familiar: we know the diagnosis, but somehow, the treatment is never fully administered.

So, what is the real problem?

Is it policy inconsistency and the lack of political will?

Is it our oligarchic market structures that crowd out true competition?

Is it regulatory capture, where watchdogs become lapdogs?

Is it our weak institutions or the culture of impunity that undermines trust?

Perhaps, it’s all of the above—and more. But one thing is clear: we can no longer afford to treat our economic challenges as separate islands. The dysfunction is systemic. That was probably why I asked for a “holistic doctor’s approach.” I didn’t want to put him on the spot but senior citizen Rose must have heard way too many lines celebrating and hoping for that elusive development of the Philippines to finally happen, and wanted the conversation to acknowledge that what we need requires not just technocratic solutions, but acultural and institutional reboot.

The private sector must demand better governance and also observe better governance in their own private corporations. When SEC Chair Lim cited the example of directors seeking for exemptive reliefs beyond nine years, I can’t help but compare it with political dynasties that we all want to get rid of. Letting go of power is such a difficult thing to do.

We’re not out of the race—not yet. But unless we shift from admiring the problem to actually solving it, the label “sick man of Asia” may not just persist—it may be engraved. Huwag naman po sana!

Let’s remember what the SEC Chair said about the little things: Let’s not do the little things we’re not supposed to do and do the little things we’re supposed to do. Just look around your own circle of influence and implement the little changes that will eventually compound into significant positive developments.

ANNOUNCEMENTS

1. We’re thinking of coming up with tiktok videos. Tell us what you think about it!

2. Watch out for our upcoming interesting podcast episodes—one about living life to its fullest despite cancer, and another one about the third act.

3. Take the FQ Test to know where you are in your FQ journey. click here.

4. Get your copies of the final installment of the FQ Trilogy, Click here.

This article is also published in Philstar.com