The Invisible Currency: Trust

Last Friday, I had the privilege of moderating a panel during the 63rd Annual Meeting and Conference of the Philippine Economic Society (PES) held at the Makati Shangri-la Hotel. It was the third of the three plenary sessions and 27 breakout sessions.

Our original timeslot was 4:05 to 5:00 pm—that challenging part of the day when people start feeling information overload and itch to start the weekend. But wait, there’s more! The conference started late, pushing all sessions later in the day. I even had to move my Friday dinner venue from Ortigas to Makati just so I could make it.

On the bright side of this delay, my three panelists and I spent more time talking—not just about our 55-minute session but also about life in general. The extra bonding time helped us connect more deeply, making up for the absence of pre-event meetings. (Tip: Big events like the PES Conference, which involve numerous speakers and other moving parts benefit greatly from hiring professional event organizers.)

Our session was titled Capacitating Households, Enterprises, and the Financial System Toward a Healthy Financial Security. Honestly, it was the first time I had ever used the word “capacitating!” It sounded so bureaucratic and academic. So, I decided to make light of it by opening our session with a quick check on the audience’s energy level—their “cognitive capacity,”—as I joked to get their attention. That bit of priming, plus the lively talks of my panelists and the easy rapport among us four ladies who had bonded for two hours, helped keep the audience engaged. Their interest was clear from the many questions they asked.

My panel members were:

- Atty. Charina De Vera-Yap, Managing Director of the Financial Inclusion and Consumer Empowerment Sub-Sector at the Bangko Sentral ng Pilipinas

- Veronica Mae Arce-Balisi, Partner at SGV handling the Financial Crime Risk Management, specializing in Anti-Money Laundering and Counter-Terrorist and Proliferation Financing.

- Kathleen Joy Domingo, Master Trainer at CyberGuardiansPH, Inc.

All three pointed out that we need to inform and educate the people—but that financial literacy must go hand-in-hand with systems that protect and empower households.

Atty. Charina De Vera-Yap discussed BSP’s Three Pillars for Financial Health: Financial Inclusion, Financial Education, and Financial Consumer Protection. She shared data showing improvements in inclusion—for example, e-money accountholders rose from only 8% in 2019 to 36% in 2021, and their usage increased from just twice a month in 2019 to six times a week in 2021. They continue to collaborate with various institutions for their financial education programs, and use the Financial Products and Services Consumers Act and Anti-Financial Account Scamming Act to ensure that inclusion comes with protection. She said that while we still have a long way to go in achieving healthy financial condition for our people, we have also traveled quite a distance.

Veronica Arce-Balisi reminded us that risk is not a switch that we can turn off, but a tide to navigate. She emphasized the importance of integrity as the quiet force that holds the financial systems together for without it, everything collapses. Criminals thrive in silence, so we have to fight back by speaking, sharing, and standing together because collaboration is our strongest defense.

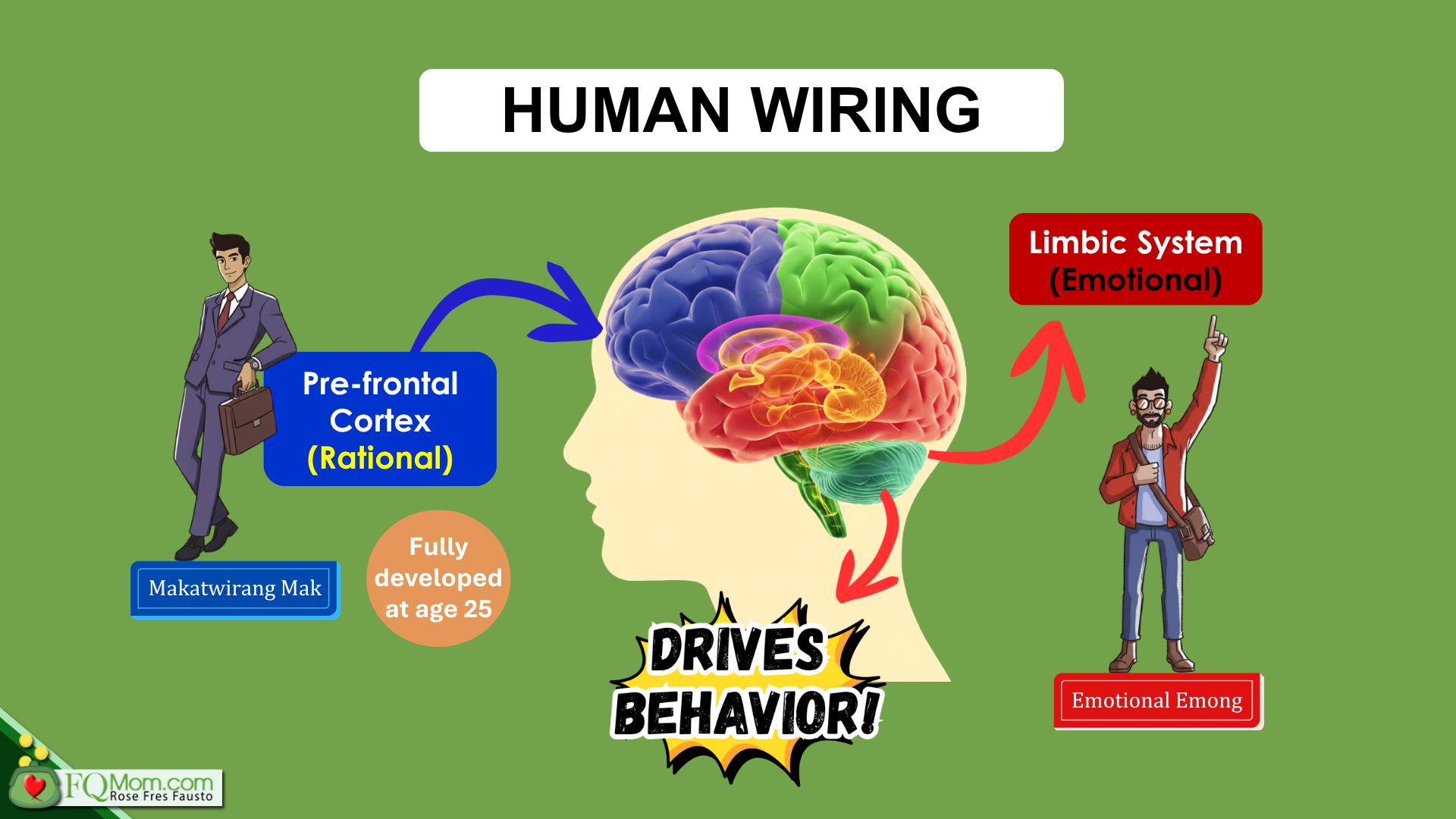

Kathleen Domingo opened her talk by emphasizing the importance of trust in the digital economy, which has been growing exponentially in the recent years. Unfortunately, so has the proliferation of digital scams. From phishing (done through emails and texts) to vishing (done through phone calls and voicemails), and more. Aside from giving us tips on no sharing of OTP and passwords, and other measures we can do individually, she mentioned the need for more structural protections from digital scammers such as cyber education partnered with clearer and easier fraud reporting, support for SIM registration, enhanced cybersecurity among fintechs, and harmonized efforts from BSP, NTC (National Telecommunications Commission), DICT (Department of Information and Communications Technology), and NPC (National Privacy Commission). During the session, I shared my simple way of explaining why Financial Education alone does not work. If you’ve been following me, you already know this. Our human wiring is such that our Makatwirang Mak is what Financial Education targets, while our actual behavior is driven by our Emotional Emong.

Given the above, we need structures in our payroll systems that automatically enable saving and investing. This does not curtail employees’ freedom of choice since there’s an opt-out feature; we just want the default to be what’s good for them. I wonder, how many employers are actually doing this. It is so simple and costs almost nothing. How about you—is your salary already structured for automatic saving and investing? If your answer is yes, congratulations for allowing the power of default to work for you. If your answer is no, what are you waiting for? I repeat, you can opt out once you decide to stop the automatic arrangement.

In concluding our session, I asked each of my panelists: Is there hope? Can we really capacitate Filipino households, businesses, and our country to become financially secure?

How about you, what’s your answer?

In unison, all four of us answered yes. We all choose hope.

But hope is not a strategy. It is not a concrete solution to our problems. Neither is financial education on its own. We need to bring strong structures designed for our human wiring (see above)—defaults that will make it easy for everyone to save, invest, and be protected from scams. And with this is the need to restore public trust.

Any talk about economy, financial wellness, progress must also confront what’s happening in our country today. Right now, the most heinous crimes are being committed against us. Blatant and rampant plunder of public funds. We have seen too much of this plus all the hundreds of lives lost to floods and other catastrophes not properly addressed due to corruption. We’ve been talking about and seeing damning evidence of these crimes for so long now, and yet not a single criminal is in jail.

Tama na! sobra na! Ikulong na!

We need to see these criminals jailed to restore public trust. Trust is the invisible currency that keeps the economy flowing. Look at our stock market—the PSEi is in pandemic-era levels. While Covid-19 was an external shock, today’s stagnation is self-inflicted!

Let us all do our part to bring back public trust. Start at home. Never justify or even trivialize dishonesty when raising your children. Remain true to your morals even if our leaders don’t seem to set that example. Without public trust, there can never be true financial security.

ANNOUNCEMENTS:

1. Watch our latest YT video to see places you can visit on your next family outing or tanan. Click here.

2. Take the FQ Test to know where you are in your FQ journey. click here.

3. What’s the one resolution everyone struggles to keep? Getting their finances in order! This Christmas, make it easy. Give yourself and your loved ones the manual for financial happiness. Don’t just wish for wealth—learn how to design it! Buy here.

This article is also published in Philstar.com